Another NFT Entrepreneur Newsletter by Clyde F. Smith

NFTs seem like relatively uncomplicated investments in a legal sense but there are warning signs and future legal possibilities to consider. NFT fractions are likely to be categorized as securities by the SEC and anti-money laundering regulators are paying attention as well. Here are some of the key legal issues of which NFT owners should be aware though this information does not constitute legal advice.

NFT Ownership Does Not Include IP Rights

Just as when one buys a physical piece of art, the intellectual property rights are not part of the NFT purchase except in cases where they are specified as included in the purchase. In the U.S., the assumption is that NFT art is treated like any other work of art though that has yet to be tested in court. Until that day, one should assume that such is the case.

Technically that means you can’t be putting your NFT art on a t-shirt or printing it out for display or a variety of other uses that may come to mind. However, many cryptoartists assume that collectors might, in fact, wish to print out a copy to hang on the wall or make other limited personal uses of the digital file.

In addition, some platforms specify additional rights and uses so, if in doubt, consult both the platform agreement for collectors and check in with the artist. They might be quite happy to tell you that you’re free to take your desired action.

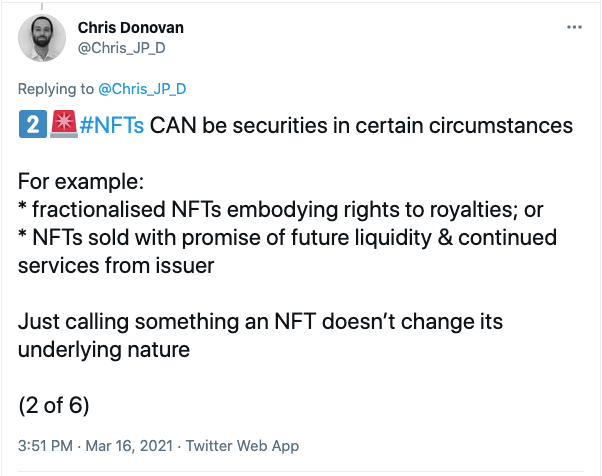

NFT Fractions and Index Funds May Constitute Unregistered Securities

Currently a number of NFT companies are exploring fractionalization of NFTs so multiple investors can participate in a high-priced offering. In this case, the term index fund is used quite differently from traditional usage in public markets. So what NIFTEX calls an NFT fraction is quite similar to what NFTX calls an index fund.

Fractionalized NFTs are currently either a single NFT or a basket of NFTs that is represented by the issuance of an ERC-20 token in a specific amount. These function much like shares in a stock market but are traded as fungible tokens on decentralized exchanges or DEXs.

Again focusing on U.S. law, SEC Commissioner Hester Peirce recently stated that fractionalized NFTs may be classified as unregistered securities by the SEC. Though she is pushing for a safe harbor provision for such rulings that will give companies additional time to come into compliance, it is unclear if that will occur. So keep in mind, based on your location and that of the company offering the fractionalized NFTs, if a relevant regulatory agency decides to act, your wonderful investment may not survive.

[For more on NFT fractions and index funds, see my recent piece for The Defiant.]

Anti-Money Laundering Efforts May Affect Your Activity

Regulators concerned about money laundering are starting to pay more attention to NFTs. For example, the Financial Action Task Force, a global organization, has added a reference to NFTs in draft guidance on defi and related activities.

In addition, anti-money laundering regulations are affecting the art auction market. This is currently focused on physical art auctions but one should consider the fact that many NFTs are auctioned online. In addition, the regulations are focused on those transactions in the area of $10,000 or more.

So it is conceivable that stricter Know Your Customer procedures will be put in place for NFT marketplaces and auction houses. Given that online companies like to automate things as much as possible and that centralized crypto exchanges require KYC procedures for all customers, such approaches may not be limited to those at the high end of the NFT market. However, if you’re not hiding behind a pseudonym, such as ArtPirateDodgingTaxes, then you’ll probably be fine.

How to Keep It Legal

If you’re concerned about legal liabilities related to your NFT investing and trading, you should, of course, confer with legal counsel. But these days there are numerous services that support folks involved with crypto in keeping track of their activities and doing their taxes. So if you keep honest records of your dealings, report what you’re supposed to report and respond to any requirements of the exchanges and marketplaces you use, it seems likely you’ll have covered your bases.

As one legal expert puts it, don’t:

“a) engage in deceptive trade practices

b) sell what you don’t own

c) use NFTs to launder money”

In addition, legal experts generally maintain that individual NFTs do not run afoul of such guides as the infamous HOWEY test.

In Closing: A Somber Legal Thought

Yes, there is a fate worse than unregistered securities, Death! Be sure to prepare your digital assets such as NFTs for that great day of transformation in which you will no longer need a wallet in any form.

Those you leave behind will be thankful for the help.